Make the most of your refund

Deposit your federal tax refund to Spruce and you can get it up to 6 days early. Plus, savings and budgeting features with no monthly or sign-up fees.

Don’t worry — we’re still available to help you file as soon as possible to limit penalties and interest if you owe.

All Free Features

All Deluxe Features

All Premium Features

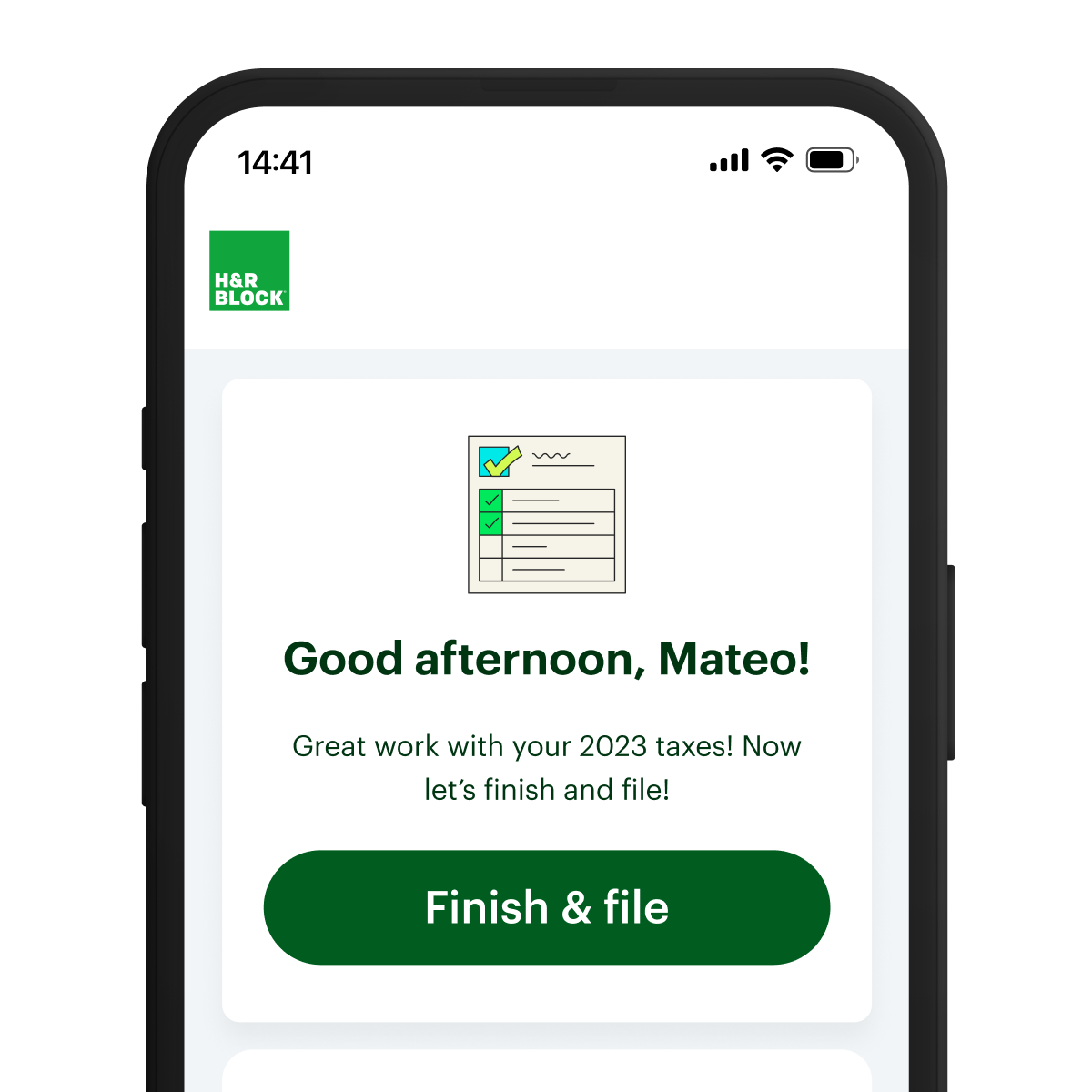

Get started for free and we’ll guide you to the right choice based on your needs.

Whether you need in-the-moment support or want a tax pro to double-check your work, we got you covered.

Just upload last year’s return (Form 1040) or we can securely transfer it for you.

935 million+

tax returns worldwide

20 million+

filed with us in 2023

5 million+

switched to Block in 2023

Deposit your federal tax refund to Spruce and you can get it up to 6 days early. Plus, savings and budgeting features with no monthly or sign-up fees.

Do your own taxes on any device with the option to use AI Tax Assist for help. Import or upload your documents at your own pace.

Spruce fintech platform is built by H&R Block, which is not a bank. Spruce℠ Spending and Savings Accounts established at, and debit card issued by, Pathward®, N.A., Member FDIC, pursuant to license by Mastercard®. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.